Today there are over 3 million loans (totaling over 90 billion) that qualify to be refinanced. This is your alternative solution to combat the reduction in mortgage applications.

Turbo-Charge Direct Lending

Stellar’s Auto Loan Recapture Program offers a turn-key program that maximizes direct loan growth and new household relationships (PFIs) while eliminating all the risk of marketing costs for our lending partners.

Once you sign on as a lending partner, you will have exclusive rights to all applications (regardless of source) in your charter footprint.

How it Works

Most consumers purchase their vehicle from the dealership based on monthly payments, not interest rates, and therefore may pay too much for their loan. Stellar uses credit bureau information to identify households in your footprint that meet your unique credit criteria profile and that are paying a higher interest rate for their auto loan than they would at your financial institution. In other words, we target our mailing to those we know can save substantially, ensuring better spread incomes for your institution.

The prospect is mailed a personalized, prequalified offer letter showing the monthly savings for that consumer if they were to refinance with your financial institution. The direct mail offer is supported by outbound calling campaigns, a microsite with secure application, after-hours inbound call services, as well as our new national lead generation website, SALrefi.com. Applications are completed and sent to your lending department for approval and loan closure.

No Out-of-Pocket Marketing Costs

All incentives, credit bureau lists, mail, postage, telemarketing expenditures, microsite, digital marketing, etc., are paid by The Stellar Financial Group – thus taking all costly risks from your financial institution. You pay nothing out of pocket until the applicants respond.

Our selection process uses YOUR rates, credit tiers, and approval regulations to maximize the loan approval process, with typical look-to-book rates of 40% to 50%. Using your standard rates, we target those households that are paying too much. Unlike your auto indirect program, YOU keep the cross-sell opportunities, GAP, MBI, AD&D, etc., making this new member a very profitable addition to the credit union.

We receive a small success fee for the funded loans that your loan department refinances as a direct result of the Stellar’s Auto Loan program. Most of our institutions are averaging around 300% ROI from the loans generated with Stellar’s Auto Loan program. Our Stellar team works with your loan team to optimize loan volume. Every two to four weeks we will target another group of qualified prospects to generate new qualified applicants, building assets for your institution throughout the year. Our partners enjoy having new, profitable relationships from members that might have never heard about your financial institution prior to our marketing campaigns.

The Strategy

How Do We Impact Your Bottom Line?

• Target new prospective households that meet your credit criteria

• Proprietary data analysis that refines your pre-approved prospect list and dramatically improves look-to-book ratios

• Market to households that will save a significant amount each month

• New consumers, generated with no out-of-pocket costs, begin generating income immediately

• Cross-sell ratios up to 94% for checking accounts

Stellar’s 7-Point Touch Process

1. Multiple mailings

2. Outbound and inbound call center

3. Online web application portal designed with the credit union’s marketing appearance

4. Reminder messaging

5. Application process support

6. Proprietary credit bureau selection model mirroring the financial institution’s credit criteria

7. Stipulations helps ensure not only a good response rate of applications but a high “look-to-book” rate

Why Is This Program So Successful?

• Unique, individual consumer offers

• No wasted efforts on non-qualified prospects

• Custom, systematic direct mail campaigns

• Outbound calling campaigns

• Extended-hours inbound call support

• Secure micro-sites

• Incentives that create buzz in the market

• Multi-touch reminder mailings

• Offer-specific landing pages

• National consumer education/lead generation platform with SALrefi.com

SUCCESS STORY

OKLAHOMA EDUCATORS CREDIT UNION | OECU.com

Oklahoma City, OK

“Stellar’s unique strategy provides an opportunity to capture current performing loans. Since the program allows direct communication with the potential members, stronger underwriting capabilities are more easily maintained and the ability to cultivate deeper relationships with borrowers is accelerated… our relationship with The Stellar Financial Group helps us to obtain LIFERS instead of just LOANERS.”

—Trent Vaughn | Senior Vice President | Oklahoma Educators Credit Union

Read More Articles From This Edition

Welcome to the Spring 2022 Edition of Stellar Insights

Welcome to this special edition of Stellar Insights. We felt this would be an ideal time to review the auto loan recapture business in detail…

Not Targeting Your Members? If you don’t, other institutions will.

Obtaining new members requires a lot of time, money, and effort. Your members are an investment, and while some churn is unavoidable, it quite literally pays to take care of your current members and nurture the relationship you have with them.…

READ MORE

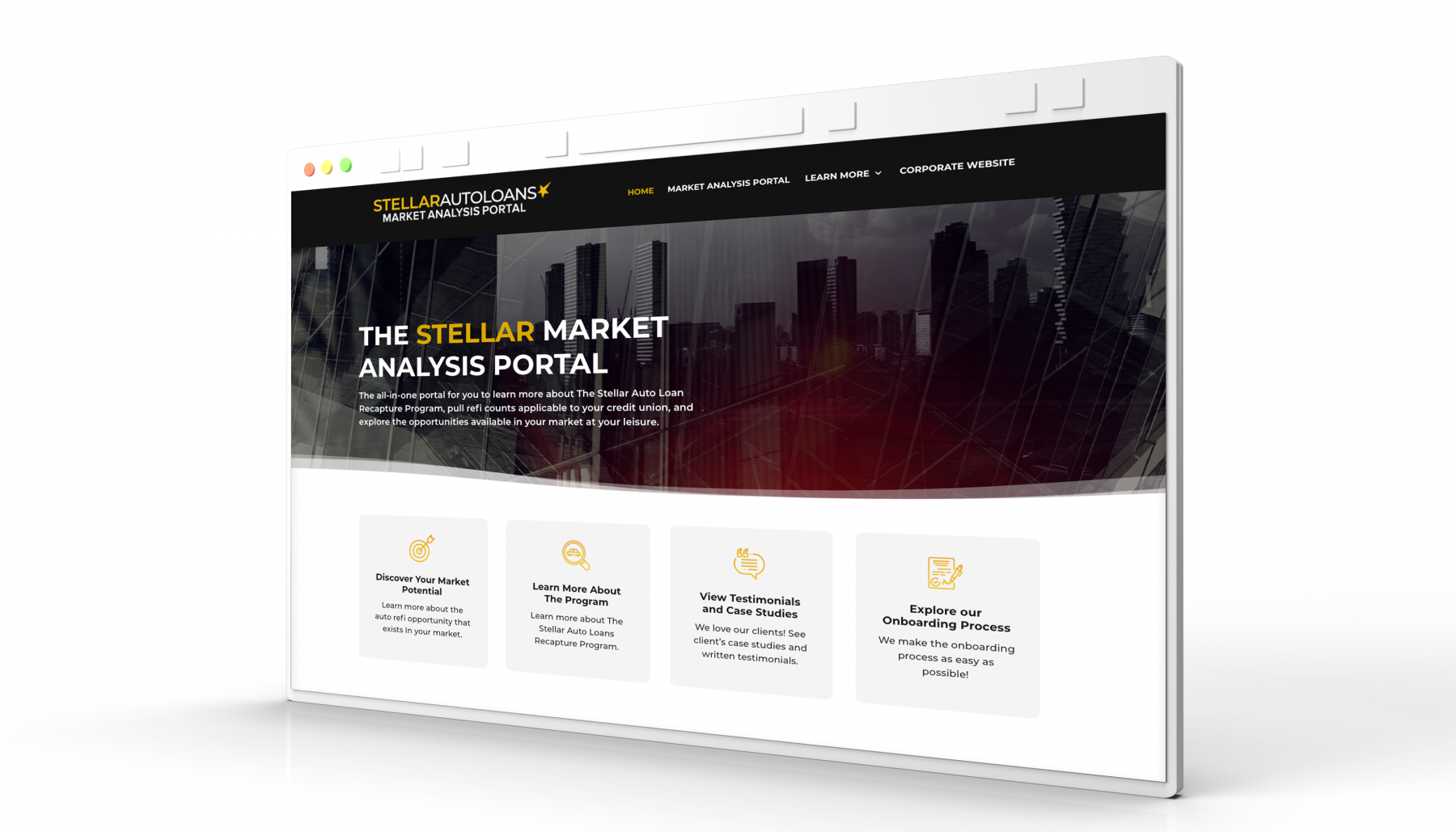

The Stellar Market Analysis Portal is HERE

This virtual marketing site allows potential clients the ability to browse our product solutions, pull auto refi counts applicable to their market, and literally explore the entire onboarding process, at their leisure..…

READ MORE