How Much of Your Portfolio is “Indirect”?

According to the NCUA, credit unions have acquired a significant portion of their auto loan portfolio from indirect loans. There’s over $1.3 trillion dollars worth of auto loans borrowed by consumers across the country, with close to 80% of these loans originating at auto dealerships.

Credit union executive teams understand indirect lending can add loan volume, usually with compressed interest rate margins and very little, if any non-interest income. Dealerships add additional basis points to the interest rate agreed by the credit union, as well as charge almost double the rates most credit unions would charge for the same services, such as GAP, MBI, AD&D, etc. In addition, dealerships add additional fees to the loan, such as “documentation fees”, “fuel charges”, etc., which quickly increase overall origination costs, and put most loans well over a 100% loan-to-value.

New auto sales have slowed due to the chip shortage needed to complete the manufacturing of many vehicle models. The used auto market volume has increased during the pandemic and appears it will continue for some time.

Indirect Loans = More $ for the Dealerships

Institutions are looking for ways to make up some of the short falls, looking at different types of auto loan recapture programs.

Many of these programs use the dealership model of packaging the loan, charging additional “process fees”, and keep the lion’s share of the non-interest income for themselves. These types of recapture programs are now being identified by the NCUA as an “indirect loan”, because the credit union doesn’t have a direct relationship with the consumer during the loan application, vetting, stipulation, and processing. They simply fund the loan, with no real direct relationship to the “new member”.

Over the years Stellar Auto Loans has helped generate hundreds of millions of dollars in auto loans for our credit union partners. We’re sharing what we see from a cost and profitability standpoint of both indirect dealership loans, as well as indirect auto recapture loans vs. direct loans generated through their lending teams. Before I go into the numbers, let’s look at the BIG Picture.

The credit bureaus are very happy to share their consumer auto loan information, (at a cost). With so many consumers purchasing their vehicles at dealerships, and dealerships are adding hundreds of basis points to the loan that the credit union will be servicing, many consumers are paying far above usual and customary market rates on their auto loans. Our data pulls from the bureaus finds that 70% of the population with an auto loan and a FICO score of 720 or better, are paying more than a 5% interest rate. This is easy to understand, because dealerships know consumers purchase vehicle by monthly payments that they can budget.

Loans from Dealerships are Vulnerable

The F&I managers at the dealerships will structure the loans to maximize their profitability. With multiple institutions at the ready to shop the loan, adding to the flat rates for even greater dealership profits, extend loan repayment periods, etc., it is easy to understand the high interest rates.

With more and more “recapture” programs having access to this information, these indirect members are extremely vulnerable to being targeted by other institutions. The dealership doesn’t care if the loan is refinanced, as long as, it is not refinanced during the typical 90 or 120 day “charge back” period agreed upon between the credit union and the dealership. I’ve had auto salespeople specifically mention not to pay off the loan within 90 days, so that they can get their commission!

Looking at our credit union partners’ auto loans, we typically see the average life of an auto loan is between 24-30 months for their entire portfolio. When we drill down to look at indirect loans, the average payoff period is typically 18-20 months. Obviously, many of these types of loans are being targeted by other institutions!

“Indirect” recapture programs have less vulnerable recaptured loans, but since there is a success fee associated with them, margins are being even further compressed vs. most dealership indirect margins. Like auto dealerships, these programs keep the lion’s share of the non-interest income. Lastly, and maybe most important, the member relationship is NOT with the credit union, but with the Indirect recapture company. When that loan is paid off, that member RARELY finances their next loan with the servicing credit union.

My point isn’t to say that indirect loans are bad, but to say there needs to be a balance of organic and direct loans to maintain dependable loan growth, as well as build more complete cross-sell member relationships.

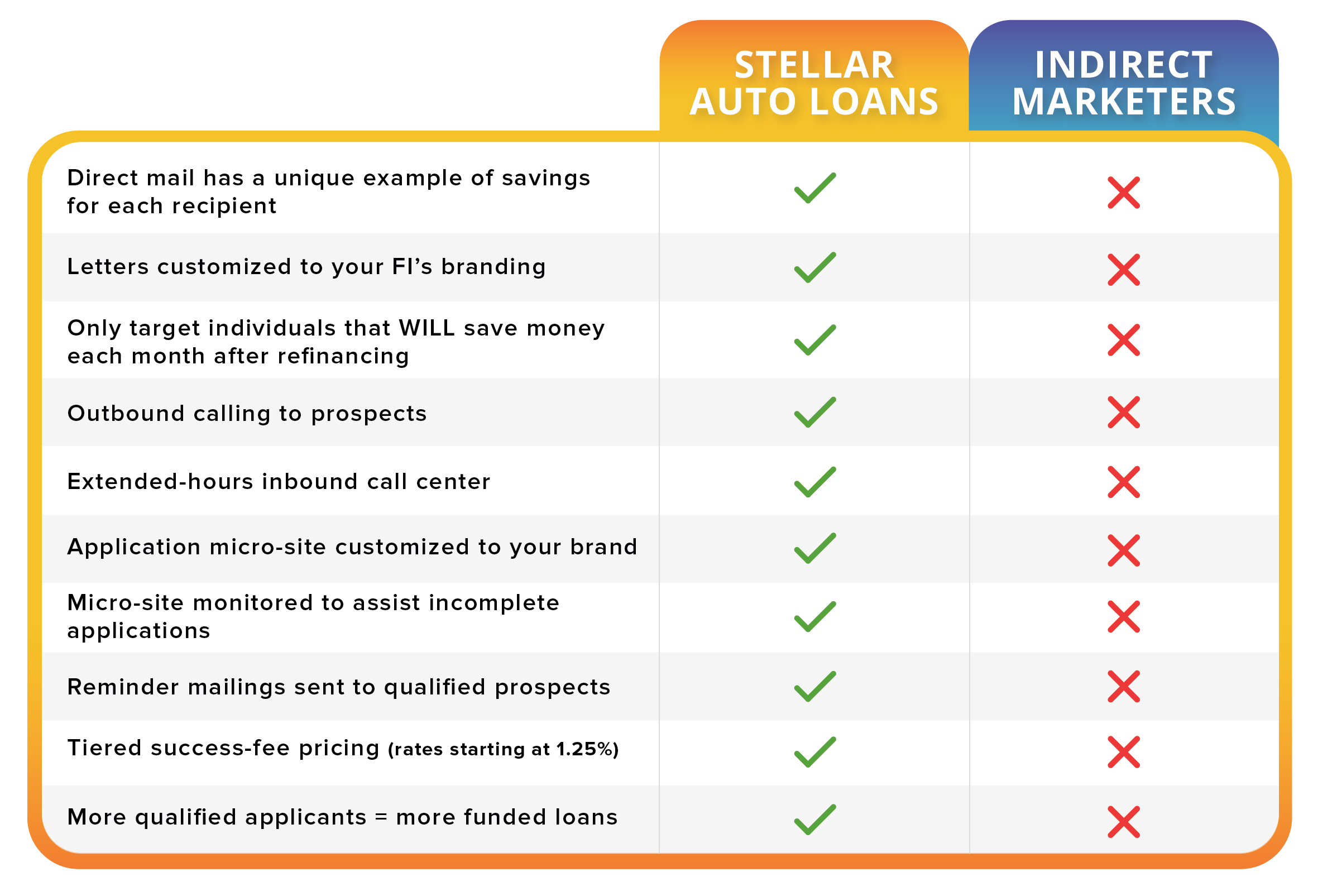

Other Recapture Programs vs The Stellar Auto Loan Recapture Program

The Stellar Auto Loan recapture program provides many more additional benefits than just profitability as compared to other “Indirect” recapture programs:

There are less charge offs with the Stellar program. These new members have great track records of being current on their loan repayments. Only those prospects that are current are targeted.

All marketing material is branded with the credit union’s brand standards. All marketing materials look like they are generated from the credit union. There is nothing about Stellar Auto Loan on the marketing messages. The credit union enjoys the benefit of increased brand awareness at NO ADDITIONAL COSTS!

Stellar’s outbound call center that follows up on the direct mail offers to pre-qualified consumers doubles the overall application response rates.

95% of the consumers targeted are non-members, that can become a member. Our program generates new member growth, and these members are instantly profitable to the credit union.

Stellar mirror’s our credit union partners credit criteria and stipulations, to insure high loan approvals. Typically, we are averaging close to 50% look to book with our credit unions.

George Monnier is a founding partner of Stellar Auto Loans, a division of Stellar Strategic Group, which offers pay-for-performance auto refinance programs to the banking industry. Contact him at george.monnier@stellarautoloans.com or 402-708-2425.

Read More Articles From This Edition

Welcome to the 2021 Fall Edition of Stellar Insights!

To help our readers plan for the new year, we have written articles for this edition of Stellar Insights that touch on relevant issues and opportunities…

A Missed-Understood Opportunity

One such opportunity that neobanks have had great success with is refinancing student loan debt. Not originating, but refinancing. This is a very misunderstood product that has tremendous potential for those willing to take a serious look at the numbers…

Overdraft and Debit Card Interchange Fees: One Big Concern, One Giant Opportunity

Many banks and credit unions have depended on overdraft fees as a substantial source of fee income. Now, combined with the end of government fee income from pandemic-related programs, such as PPP, what can banking institutions do to make up for their lost revenue?

Introducing The Stellar Market Analysis Portal

COMING THIS FALL. This virtual marketing site will allow potential clients the ability to browse our product solutions, pull auto refi counts applicable to their market, and literally explore the entire onboarding process, at their leisure.