We have all seen the studies. Most consumers are living from paycheck to paycheck. Since the Great Recession, the median income has fallen by 13% from 2004 levels, while expenditures have increased by nearly 14%.

In another recent study, it was determined that nearly half of the consumers in the U.S. have less than $400 in disposable income above their monthly budget. They would need to find alternative financing if an emergency occurred with a cost greater than this amount. One unexpected expense, like a broken pipe or unexpected car repair, would disrupt a household’s entire budget. Consequently, consumers have become VERY expenditure conscious, trying to find new ways to save money each month. Since auto loans are typically one of the top three monthly payments for many household budgets, most consumers would be interested in saving money by refinancing their loans.

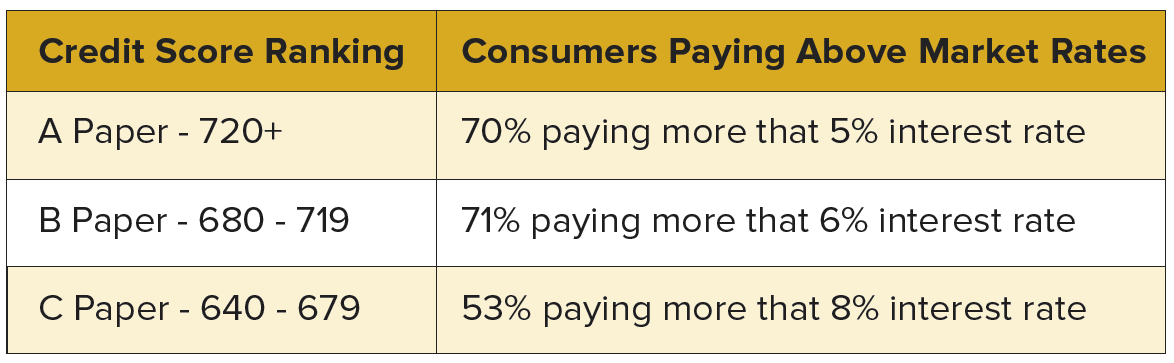

Those of us working in the financial industry understand that the interest rate is important to the repayment of a loan. Consumers know this too, but at the time they are purchasing a new vehicle, they are far more concerned about how the total monthly payment amount may affect the balance of their checkbook. Proof of this is the volume of consumers paying a higher interest rate than what many local, community-based financial institutions typically charge. Consider the data in the chart below:

So, what are some of the best practices to recapture profitable auto loans?

Focus on monthly payments, not rates. Speak your prospect’s language. Focus the offer on what is most meaningful to their bank accounts (monthly payment) over what is most meaningful to a bank or credit union (interest rate). Use credit bureau data. This data is very critical in determining which households could save monthly and yearly on their auto loans. You can create a very compelling and personalized offer for that consumer, thus generating more interest and response. This data also allows you to pre-qualify prospects based on your institution’s credit approval criteria. Though this may involve additional front-end time and expense, using a pre-qualified consumer list will create higher conversion rates of applications to funded loans. Plus, it will save your loan officer’s time as well. Use multiple channels and provide several easy response options. It shouldn’t need to be said, but please make your response options easy for the consumer. Give clear direction and offer alternative ways for them to respond. That includes online response forms as well as the more traditional phone number, email, or branch visit. Also, we highly recommend following up with a phone call as well. Just remember that most families now have two wage earners. The best time for them to communicate may be in the evening, after work. Calling during normal business hours may leave you with a lot of unanswered phone calls. Create incentives to encourage actual applications. After all, you have pre-determined which prospects are pre-qualified with your institution’s credit criteria and you have already determined you can reduce the prospect’s monthly payment. Any application received should produce a high closing rate. The extra upfront analysis and credit data will drive responses that are well worth the extra time and cost. In addition, a personalized message tells the consumer that your institution must be confident that you can reduce that household’s monthly payments. That is a powerful underlying message! Create additional loan funding incentives. Okay, you have a well-qualified application on your desk, now offer an additional incentive to help close the deal. For instance, two delayed payments have great results, considering the fact many consumers are living “paycheck to paycheck”. Plus, it is easy for that applicant to understand the benefit, and your institution will still accrue interest during that time frame. Find a marketing partner with experience to minimize your out-of-pocket expense. It is easy to send out a postcard or mailer featuring interest rates. However, to generate the best response and the most funded loans it takes some coordination, data analysis, creative knowledge, and insight to get there. Pay-for-performance marketing programs are few and far between. At Stellar Auto Loans, we offer a pay-for-performance program minimizing your risk related to upfront marketing costs.After utilizing these best practices, many financial institutions are finding success!

Take this one example: A $750M asset credit union wanted to focus on households across all credit tiers. The pre-qualified offers were evenly distributed across all paper grades. We utilized the current credit rates the institution could offer with the rates of the consumer’s current loan, as well as any credit criteria restrictions. In this instance, we targeted consumers with $10,000 or more in remaining balances. After the campaign, closed loan data was used to match back to households receiving the personalized offer. Our client’s data showed over $1.8M in newly booked loans came from our program. The refinanced members saved an average of over $95 per month on their new loans, or over $5,000 over the life of the loan. The average blended interest rate for all funded loans was 7.78% (which was not a discounted rate) and was expected to bring over $293,000 in interest income alone. This does NOT include the additional non-interest income from cross-selling, AD&D, GAP, MBI, or other relationships generated from establishing the auto loan, such as checking. With interest income alone, this institution had an ROI of 473%! Also, this credit union had no up-front costs. Their success was based on the program’s performance. Many other financial institutions that have implemented our program have achieved similar results. It just goes to show…a well-defined strategy can generate great results in the auto loan recapture market.George Monnier has spent over 18 years helping financial institutions generate new deposits and loans. He is a founding partner of Stellar Auto Loans, a division of Stellar Strategic Group, which offers pay-for-performance auto refinance programs to the banking industry. To learn more about Stellar Auto Loans, please contact george.monnier@thestellarfinancialgroup.com or call 402-708-2425.